Renters Insurance in and around Sugar Grove

Renters of Sugar Grove, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through deductibles and providers on top of managing your side business, your pickleball league and family events, takes time. But your belongings in your rented property may need the impressive coverage that State Farm provides. So when trouble knocks on your door, your souvenirs, home gadgets and sound equipment have protection.

Renters of Sugar Grove, State Farm can cover you

Renters insurance can help protect your belongings

State Farm Has Options For Your Renters Insurance Needs

You may be wondering: Can renters insurance help protect you? Imagine for a minute what it would cost to replace your belongings, or even just a few of your high-value items. With a State Farm renters policy backing you up, you don't have to worry about abrupt water damage from a ruptured pipe. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Larry Laino can help you add identity theft coverage with monitoring alerts and providing support.

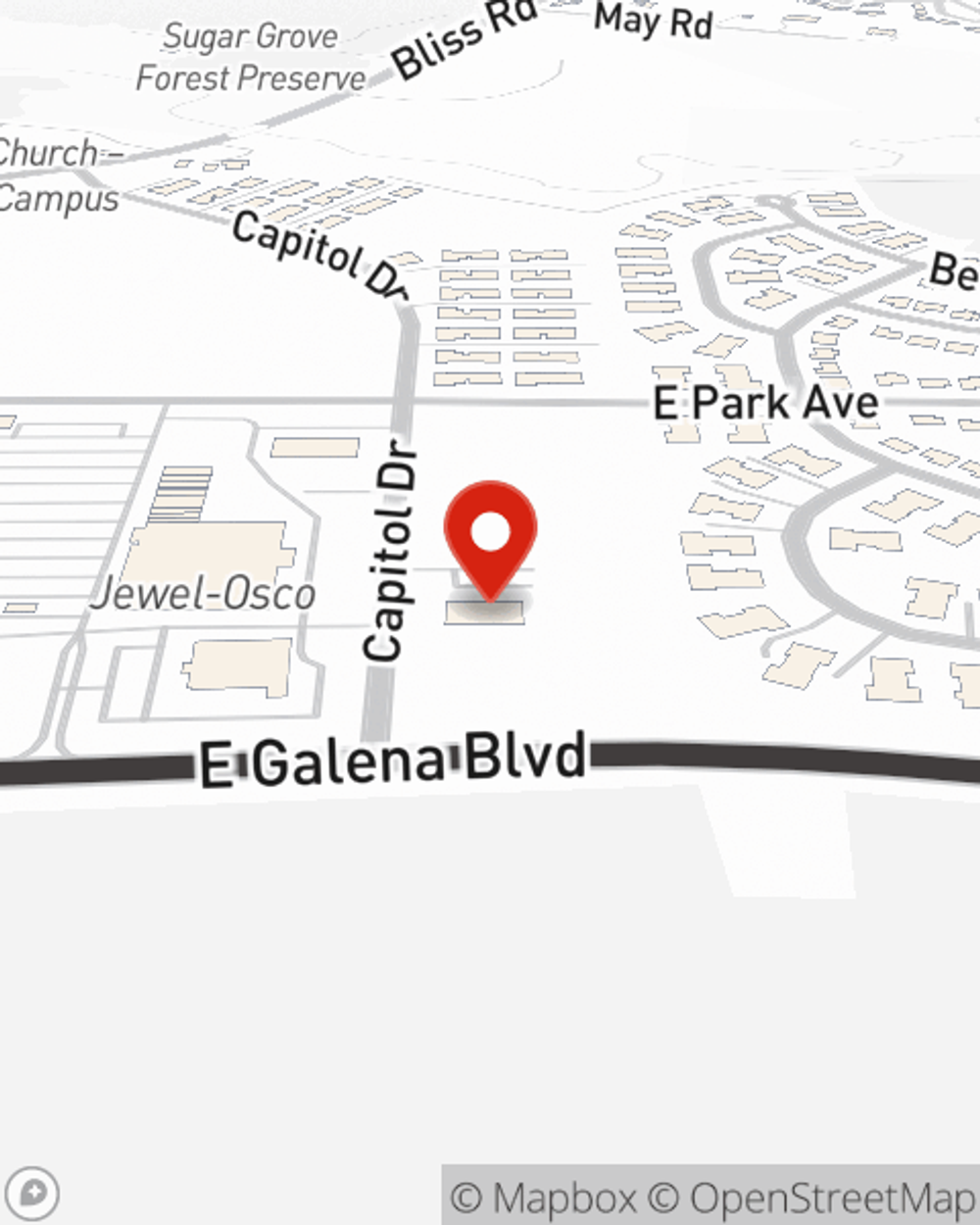

State Farm is a dependable provider of renters insurance in your neighborhood, Sugar Grove. Get in touch with agent Larry Laino today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Larry at (630) 466-1144 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Larry Laino

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.